Last Updated: 5/28/2024 | 6 min. read

This past month, Bitcoin, Ethereum, and crypto more generally were all mentioned in an American Presidential primary debate for the first time ever. The notion that Bitcoin and the crypto asset class are more politically relevant than ever is corroborated by a recent national survey called 2024 Election: The Role of Crypto conducted on Grayscale’s behalf by The Harris Poll. Key takeaways include:

- Voter concerns around inflation underscore the significance of Bitcoin in an election year.

- 46% of voters say that they are waiting for additional policies before investing in crypto.

- Half of young voters, who own crypto at higher rates than equities, are considering candidate positions on crypto before casting their votes.

Concerns around financial stability and inflation lead to interest in crypto

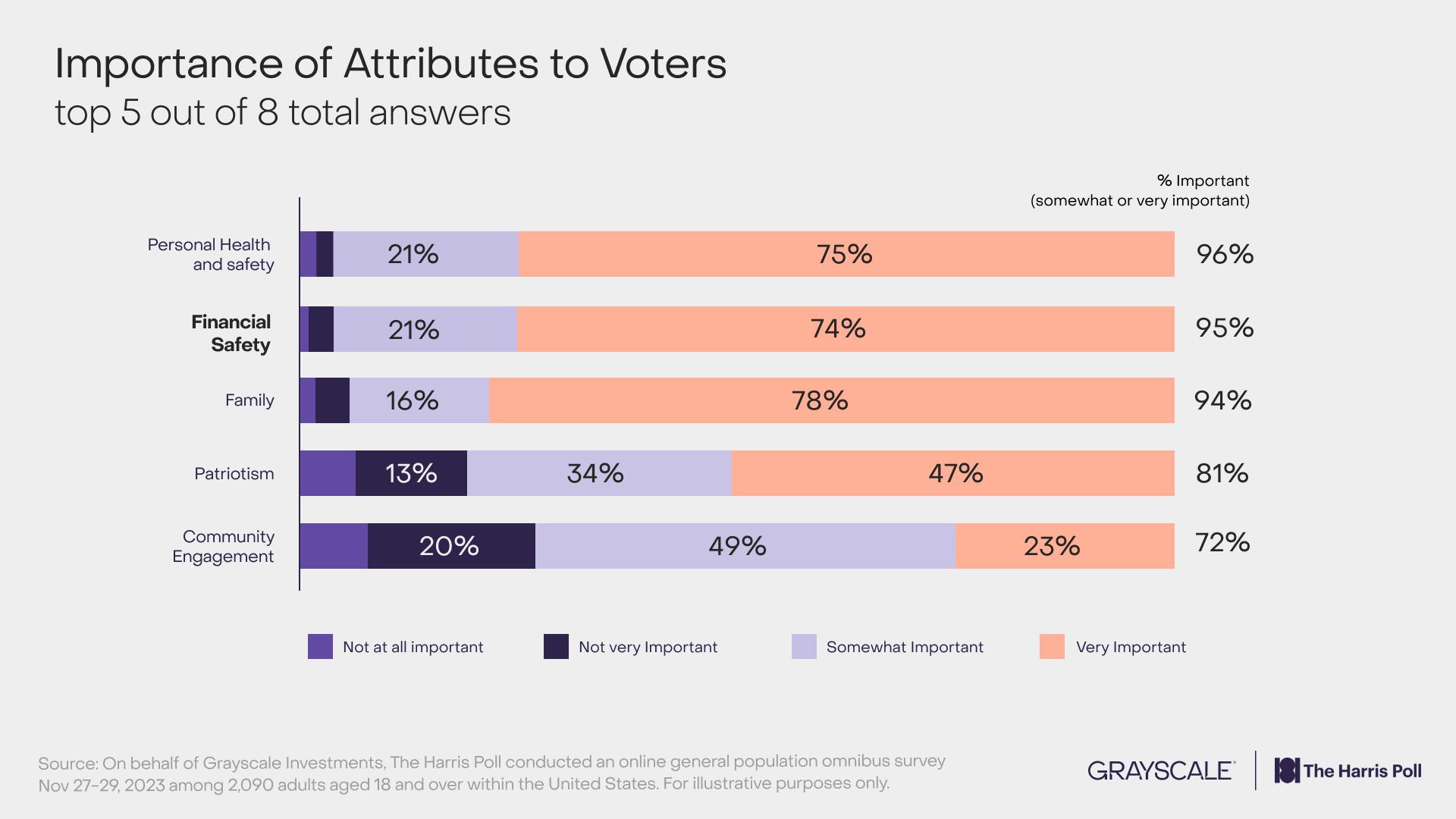

Today, crypto is relevant to Americans, as voter concerns around financial stability and inflation dominate. This is reflected in voter values: respondents chose “financial stability and being able to pay my bills” as the second most important value, ahead of other options like family, patriotism, community engagement, and finding purpose.

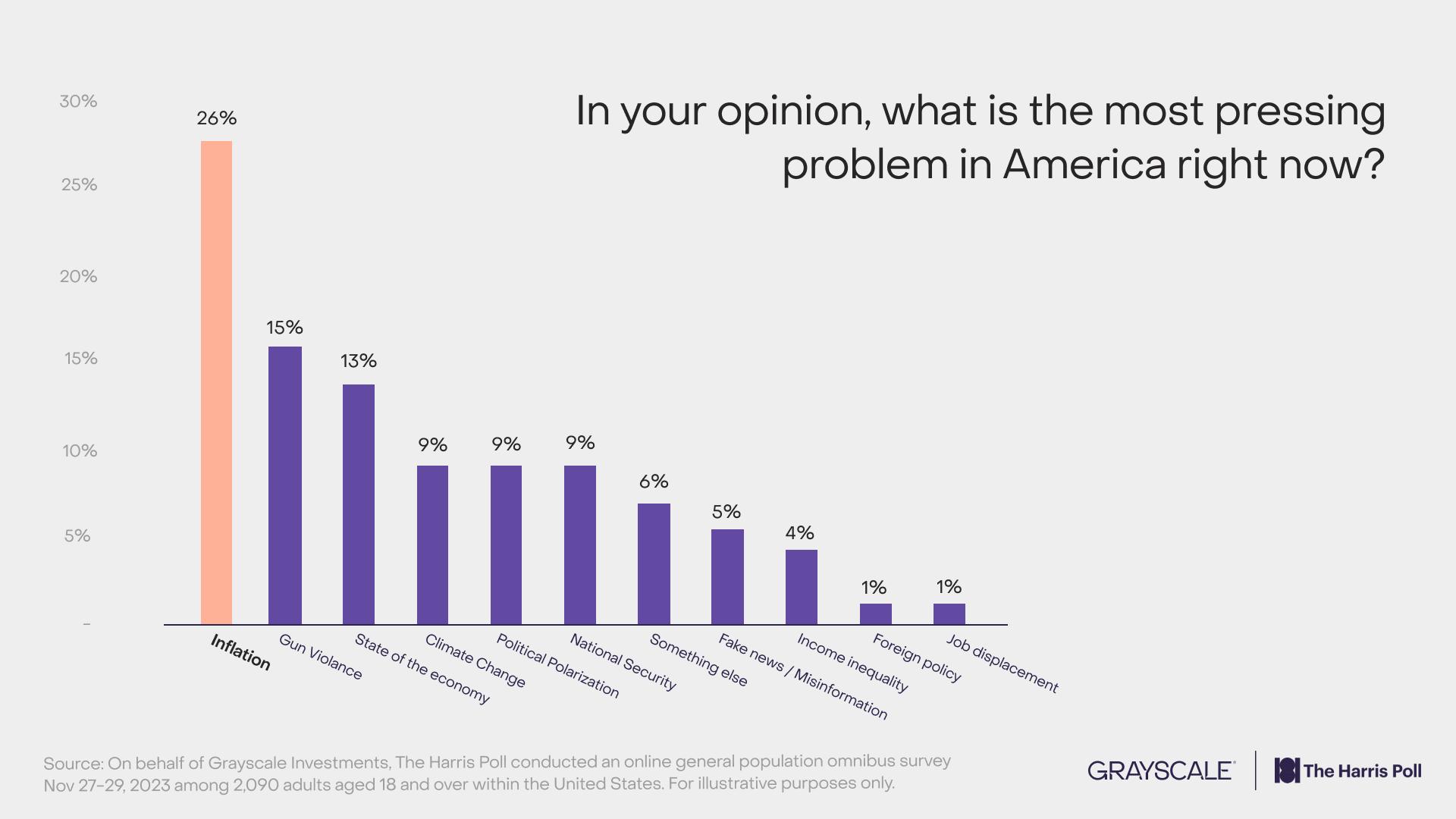

According to respondents, the single most pressing problem in America today is inflation by a wide margin, as depicted in the graphic below. This finding is directly relevant to crypto, and in particular Bitcoin, which has traditionally been correlated with monetary debasement*.

* Macheel, Tanaya. “Bitcoin is a ‘critical hedge’ against currency debasement and return of inflation, Jefferies says.” CNBC, 5 Oct. 2023.

In the past, inflation and other economic concerns have generated interest in investing in assets like Bitcoin. This could be because Bitcoin’s hard-capped supply allows it to function as a store of value asset akin to a digital version of gold. Interestingly, the more familiar respondents were with crypto, the more likely they were to be interested in Bitcoin due to inflation or other macro events. This suggests two things: one, that those familiar with Bitcoin see it as a macro asset and, two, that there may be additional education needed to help a broader audience better understand nascent technologies, like Bitcoin, for there to be greater mainstream adoption.

Crypto is held by voters across diverse backgrounds

Nearly 7 in 10 respondents report owning some type of investment asset, and nearly 1 in 5 (19%) say that they own crypto, particularly men (23%), Black / Hispanic voters (26%; 32%), and younger voters (31% of Gen Z). These same demographics are also among the most likely to report that inflation has made them more interested in crypto (25% for men; 36% and 39% for Blacks, Hispanics; 40% for Gen Z versus 6% of Boomers).

While the post-FTX landscape has not brought any growth in the percentage of Americans who own crypto, these demographic trends and other findings provide a note of optimism: 40% of investors agree that their future portfolio will include crypto.

Young voters see crypto differently

More Gen Z and Millennials own crypto (31%; 35%) than equities (17%; 24%), and a majority of Gen Z and Millennial voters agree that "Crypto and blockchain technology are the future of finance" (54%; 58%) and a substantive majority (68% for ages 18-34) agreed that they would be “much” or “somewhat” more likely to invest in crypto if there were clearer policies and/or regulations.

Looking ahead to 2024

This past year, we’ve seen Presidential candidates express diverse viewpoints on crypto-related topics within and across political parties. In the future, the Grayscale team believes that Bitcoin may face tailwinds, including the 2024 Bitcoin halving, a potential spot Bitcoin ETF approval in the United States, and potential rate cuts from the Fed.

We’ll be tracking how these voter data points change with additional polling waves in the months to come, so stay tuned and please subscribe to keep apprised of updates.