Last Updated: 5/29/2024 | 9 min. read

Harris Poll Phase 2: The “Bitcoin Election”?

Harris Poll conducted a survey on behalf of Grayscale on voters in the 2024 US Election. The latest longitudinal survey data from Phase 2 (captured between April 30th and May 2, 2024) reinforced the findings from the first phase and underscored that American voters continue to have many of the same priorities and attitudes since Phase 1 was fielded in November 27-29, 2023. However, there have been some noteworthy shifts in interest and perception around owning crypto and how voters are thinking of crypto in the political landscape — both increasingly important topics leading up to the 2024 US Election.

Ahead of the June 2024 US Presidential debate between Biden and Trump[1], voters are expressing uncertainty and the feeling that the stakes are substantial: Wars rage around the world, political discourse continues to be deeply polarized, and inflation is persistent in the US economy, among other things. The two likely Presidential candidates present drastically different visions for the country—and nearly half of registered voters say they would replace them if given the choice[2]. Amid this uncertainty, crypto assets are increasingly relevant to voters, as uncovered in the latest survey conducted by Harris Poll on behalf of Grayscale. Key takeaways include:

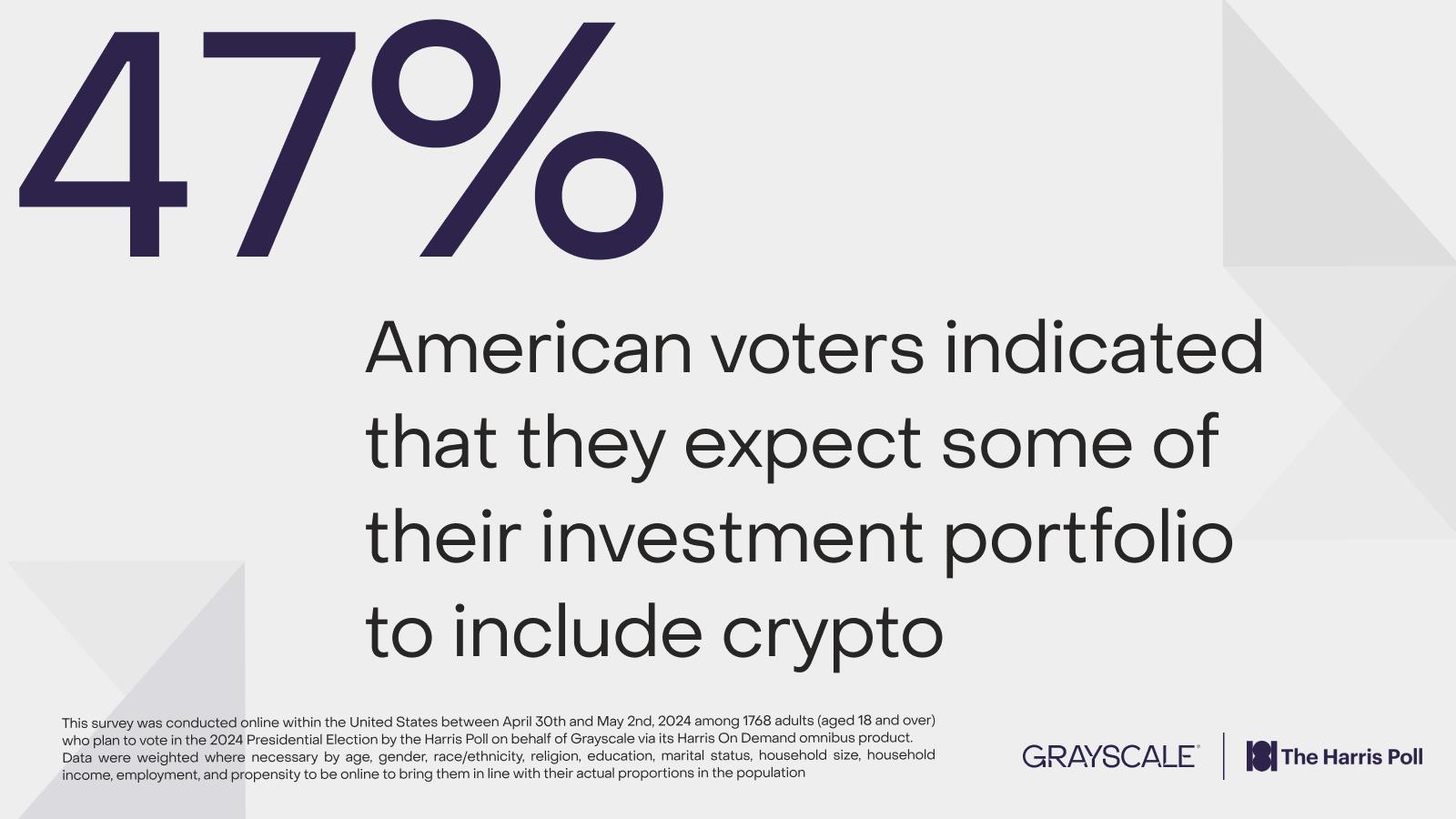

- We believe Bitcoin’s relevance is increasing due to macro dynamics and its own maturity, and nearly half of voters (47%) now expect some of their investment portfolio to include crypto (up from 40% just late last year).

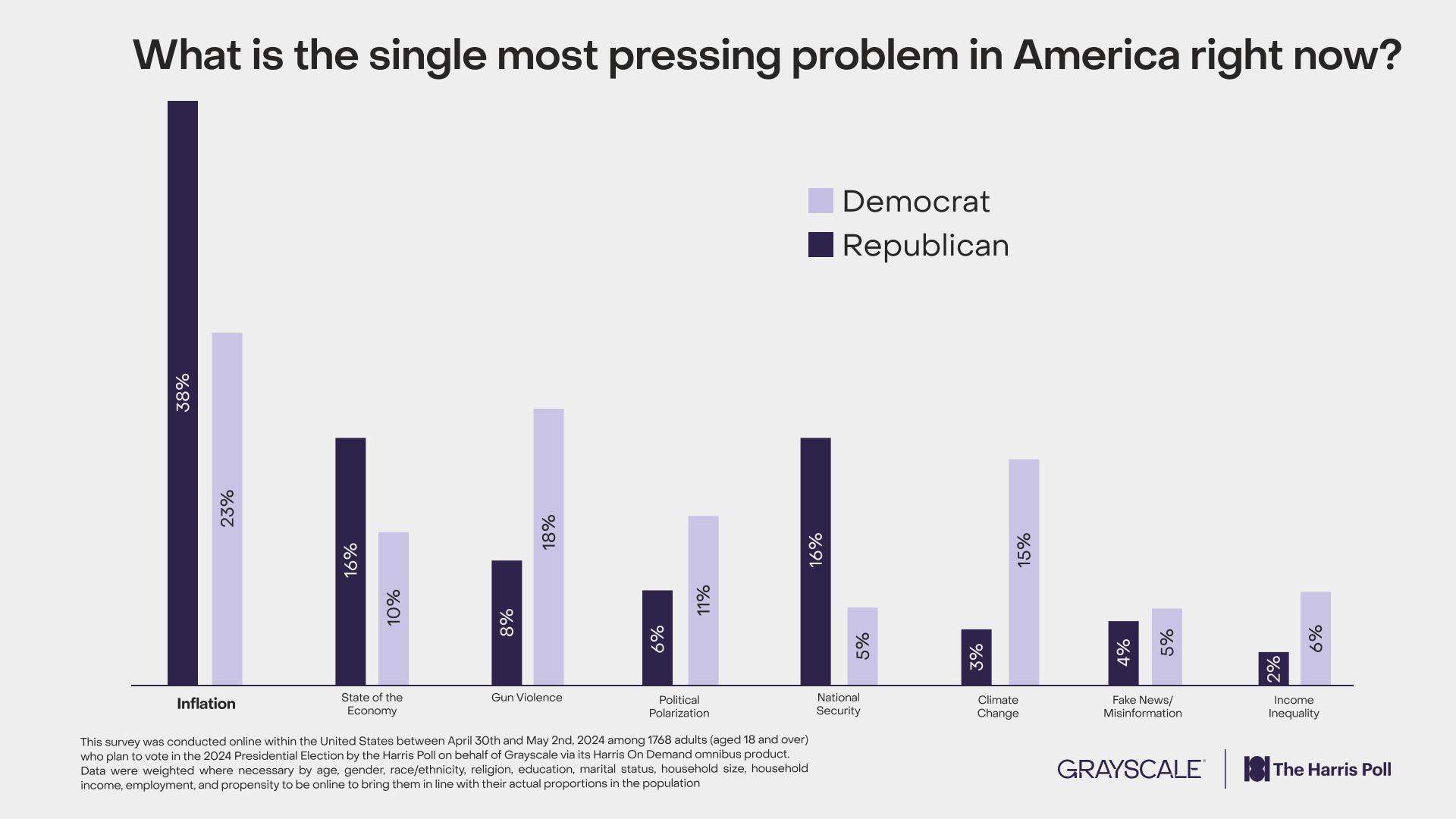

- As in Phase 1 of polling this year, respondents ranked inflation as the top issue in the election (28%), again underscoring the potential value of assets like Bitcoin with a transparent and hard-capped supply.

- Trump is embracing crypto on the campaign trail, and now recent crypto bills, FIT21 and SAB 121, have received bipartisan congressional support. Harris Poll data supports the notion that crypto is a bipartisan topic, with similar ownership rates among Republicans (18%) and Democrats (19%).

- The speculation and headlines have begun: Could November be “the Bitcoin Election”?

Growing Spotlight

Grayscale believes the spotlight on Bitcoin is growing as a result of macro developments and the maturation of Bitcoin as an asset. Over the past six months, since Phase 1 of this survey, voters have been paying more attention to Bitcoin because of geopolitical tensions, inflation, and risks to the US dollar (41% vs. 34% in November 2023). Notably, inflation is by far the top issue in the election according to voters (28%), underscoring the potential value of assets like Bitcoin with a transparent and hard-capped supply.

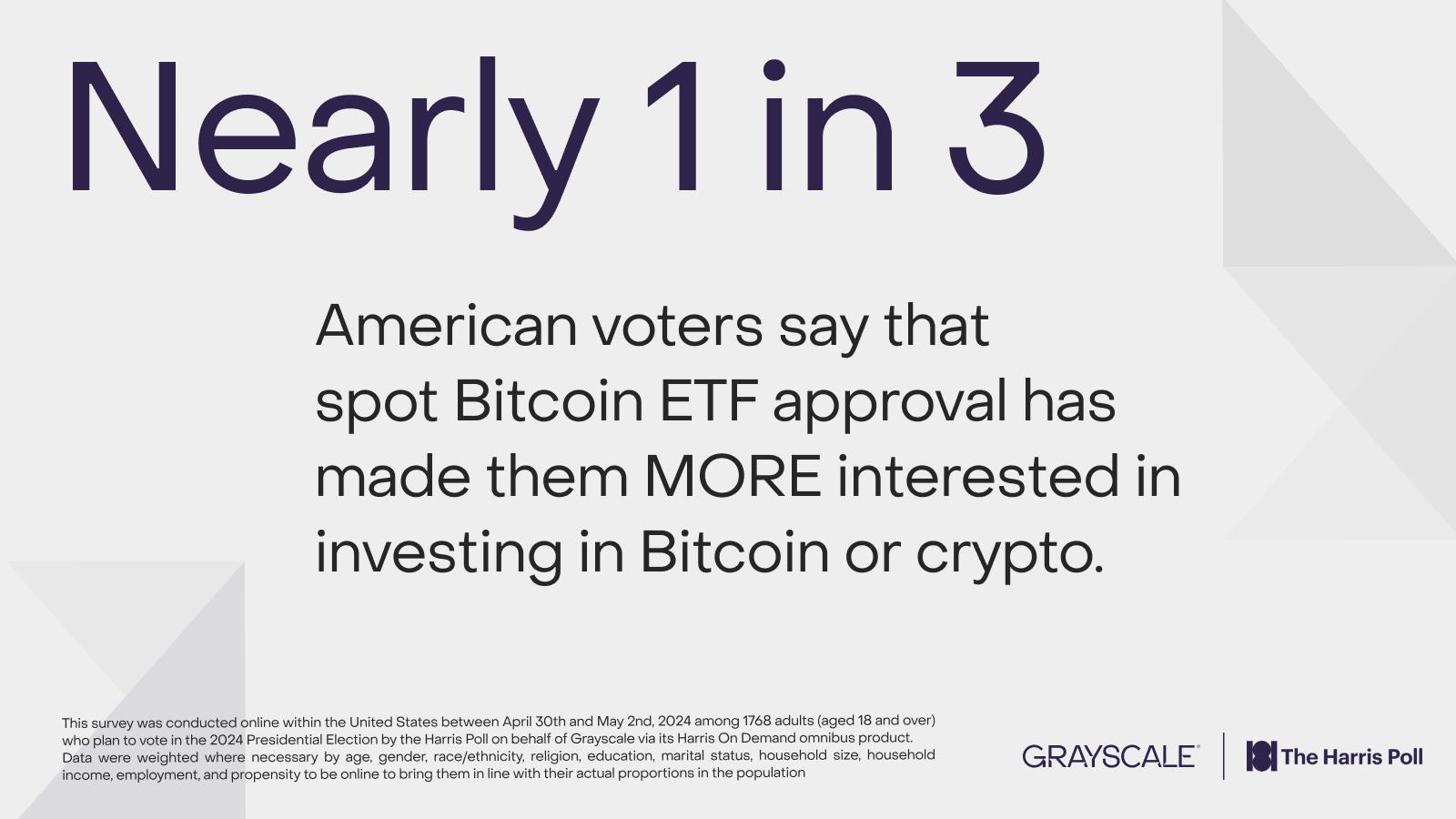

Importantly, the Grayscale team added a few new questions to the survey for consideration, and the Harris Poll found that Bitcoin-related events, including the US spot Bitcoin ETF approval in January 2024 and the Halving in April 2024, have made voters more interested in investing in Bitcoin and other crypto assets (18% and 20%, respectively)[3]. The Bitcoin ETF approval, in particular, made 9% of retiree voters more interested in investing in Bitcoin or crypto assets.

Exhibit 1: Voters increasingly focusing on Bitcoin

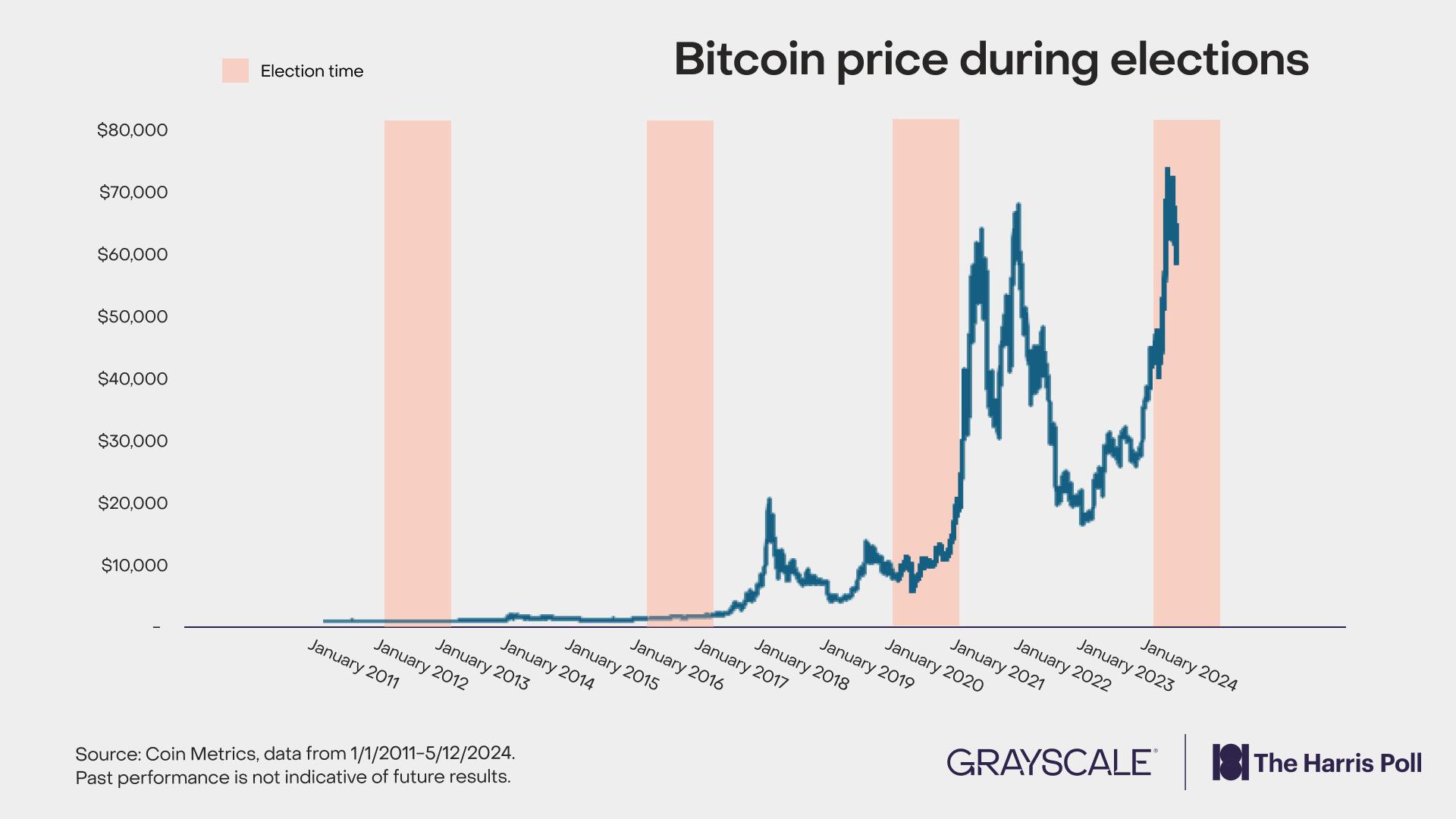

2024 to date has been a banner year for Bitcoin. Bitcoin’s price hit an all-time high on March 13, 2024[4]; in addition, Bitcoin’s price has been higher than it has ever been in previous election years for every day thus far in 2024[5]. The speculation and headlines have begun: Could November be “the Bitcoin Election”?

Exhibit 2: Bitcoin price is higher than during previous elections

This growing spotlight on crypto is not limited to just Bitcoin. Instead, it extends to a broader view of crypto assets, both in terms of general interest and a willingness to invest. Nearly a third of voters (32%) say that they are more open to learning about crypto investing or actually investing in crypto since the beginning of the year. Compared to November 2023, voters are also more likely to see crypto as a good long-term investment opportunity (23% vs. 19%) and increasingly expect some of their investment portfolio to include crypto (47% vs. 40%).

Exhibit 3: Voters increasingly expect their portfolio to include crypto

Crypto is a Bipartisan Political Issue

Although Trump is embracing crypto more on the campaign trail, data shows that crypto is a bipartisan issue, with similar ownership rates among Republicans (18%) and Democrats (19%).

Voters are split on which party is more favorable to the industry, as an equal percentage of voters (30% each) think that both the Democratic and Republican parties have the most favorable position on crypto policies. These findings demonstrate that support for crypto isn't overwhelmingly biased toward one party and suggest a balanced interest across the political spectrum. This aligns with recent bipartisan support across Congress for a resolution of SAB 121 that enables financial institutions to serve as custodians for digital assets, which may enhance accessibility to crypto investors[6].

Still, Republican voters tend to view issues around inflation and the economy as the most pressing issue facing America (54%, vs. 33% for Dems). While ownership levels are similar across parties, issues related to Bitcoin and crypto (inflation and economics) seem to be valued relatively more by Republicans, while data shows Democrats tend to care more relative to Republicans about issues like gun violence, climate change, and income inequality, as shown below in Exhibit 4. This may explain why Trump has recently leaned into crypto on the campaign trail.

Exhibit 4: Single most pressing problem by party

Conclusion

America is facing a fork in the road in more ways than one. Both candidates have different macro policies regarding government deficits and debt, inflation and Federal Reserve independence, and the US role in the world; each of these stances have direct implications on the US Dollar and Bitcoin.

With voters increasingly interested in crypto, the next administration's approach to this emerging digital asset will be important. This is particularly key for the youth vote, as 62% of Gen Z and Millennial voters believe crypto and blockchain technology are the future of finance. Regardless, as we approach November, it seems clear that crypto will increasingly be considered by policymakers and candidates across all offices that are preparing to run for office in the 2024 election.

Methodology

This survey was conducted online within the United States between April 30th and May 2nd, 2024 among 1,768 adults (aged 18 and over) who plan to vote in the 2024 presidential election by The Harris Poll on behalf of Grayscale via its Harris On Demand omnibus product. Data were weighted where necessary by age, gender, race/ethnicity, region, education, marital status, household size, household income, employment, and propensity to be online, to bring them in line with their actual proportions in the population – and was compared to “Phase 1” data that was conducted by these same parameters at the end of November 2023. Respondents for this survey were selected from among those who have agreed to participate in our surveys. The sampling precision of Harris online polls is measured by using a Bayesian credible interval. For this study, the sample data is accurate to within +/- 2.5 percentage points using a 95% confidence level. This credible interval will be wider among subsets of the surveyed population of interest.

[1] Washington Post

[2] Pew Research

[3] The spot ETF approval made respondents more interested in investing in Bitcoin and other crypto assets at a rate of 18% while the Bitcoin Halving made voters more interested in investing in Bitcoin at a rate of 20%.

[4] Coin Metrics

[5] Coinmarketcap

[6] Financialservices.gov